My approach to investing

Let's dispense with the customary legal disclaimer:

I am not a financial advisor but I do like cookies. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary.

It should also be noted that I'm Canadian, so I'll be throwing around terms that make more sense in that context e.g. RRSPs, TFSAs, etc.

Psychology

I think from a fairly early age, I've always been good at saving money. If I were to judge my childhood self, I'd like to think I was fairly judicious when it came to spending. I did get an allowance (albeit in fairness I probably didn't do much to earn it).

I'm not frugal, since I can attest to the fact that I do (unfortunately) make impulse buys. Nothing extravagant though. Calling me penny wise, pound foolish might be very unfair and too extreme, but there would be a hint of truth to it if I'm being honest.

I think a lot of kids' money habits are derived from that of their parents to some extent. As the child of educated and upper-middle-class immigrants (who sacrificed a lot of privilege to come to Canada to provide me with better opportunities) - hard work, honesty, tenacity, and humbleness are not unfamiliar concepts.

Early savings

Baby steps. GICs + savings accounts. Nothing risky. Built up enough to put a downpayment on a house (with lots of parental help, I might add)

Foray into mutual funds

Distinctly recall going into the Morgan's Grant TD branch and asking to speak to an advisor about starting a mutual fund account. Sat down with her (incidentally she was also the branch manager at the time), filled out an investor profile, and went about the process of creating the account.

- TD Monthly Income fund

- Not exactly the worst fund at a 1.48% MER

- Equity/income ratio of 60/40

- Pays monthly distributions - which has quite the psychological boost I must add, giving you the impression your money is growing

- Put in a lump sum and a fire-forget automatic authorization to contribute every paycheque

- Accessible/managed directly in the TD easy web banking interface (i.e. didn't need access to the TD web broker trading interface)

TD e-series

As an early twenty-something at the time, I did a lot of research. The 60/40 split was too conservative for the amount of runway I had till retirement at 65. The goal was to

- increase the % of equity

- reduce MER costs

I discovered Dan Bortolotti's Canadian couch potato site fairly early on. He had at the time a set of model portfolios based on risk tolerances and catered to specific institutions (if memory recalls, TD's e-series and Tangerines funds were pretty popular at the time)

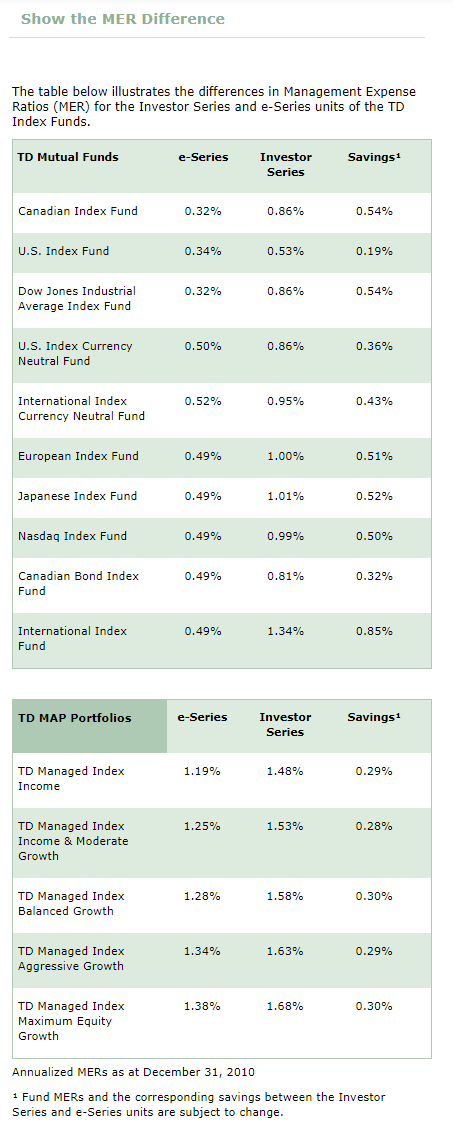

At the time (not sure about these days), TD didn't exactly promote their lower-cost e-series funds. You had to jump through hoops to get an account set up. Visiting a physical branch was futile since they were unable to assist (or feigned ignorance, I don't know). You'd have to send in paperwork via snail mail, but once setup the options were pretty amazing. Here are some of the MER rates from 2010

So what I'd do is have a preauthorized set of transfers from each paycheque into the CDN/US/Intl/Bond funds. I'd periodically rebalance funds once or twice a year (for more information on why rebalancing is a good thing, read this)

If you were ok with paying TD to do the rebalancing for you, you could optionally get their MAP portfolio funds which I likened to a pre-packaged set of the e-series funds that were automagically rebalanced. Umm, no thanks; I'm perfectly capable of creating a spreadsheet :)

Wealthsimple & ETFs

I think fairly early on I decided I never wanted to go the active route and/or buy some advisor-recommended mutual funds.

In early 2018, I heard about this new financial startup called Wealthsimple - they were offering something I appreciated: research-backed robo-advising. To top it off, they had Halal and socially responsible options too!

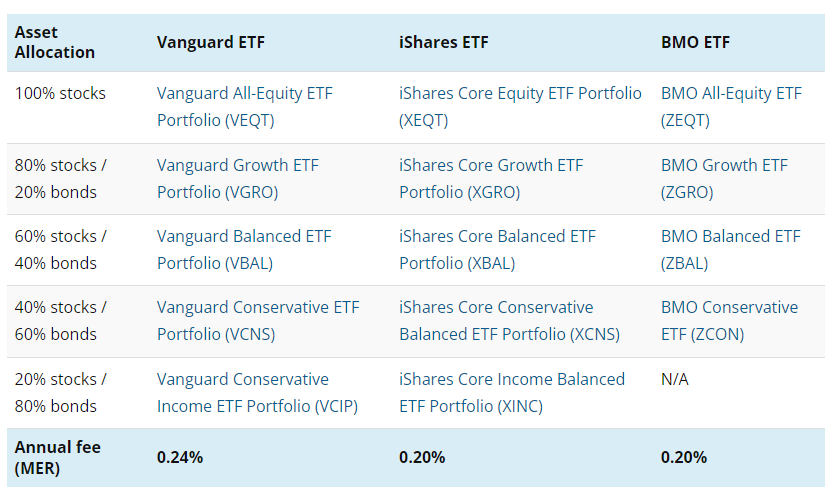

As Wealthsimple continued to offer more products and services, they eventually zero-commission trades! Wow. At the same time, ETFs were starting to get more traction as well. Guess what I did? Went all-in and transferred most of my investments into Wealthsimple trade (across non-registered and TFSA/RRSPs)

The Canadian couch potato site has also switched its model portfolios to use these ETFs now. https://canadiancouchpotato.com/model-portfolios/

I'm a bit older now, but I still have roughly 25 years till retirement. For the RRSP account at least, I've focused on going in 100% equity. Time will tell if I end up reducing the % as I get closer to retirement.

Current setup

It goes without saying, that things are subject to change. No plans are truly static.

Employee stock purchase plan

This allows participating employees to purchase company stock directly, usually at discounted prices (e.g. 15%). I currently contribute 3% of pay going to this; it's an American company so I have an account with Morgan Stanley At Work (previously eTrade). Once the shares have settled, I usually sell right away to limit exposure to any market swings - get a cheque for US dollars mailed to me; that I then deposit into my TD US dollar account. From there it could go into a variety of places. I tend to resist the urge to convert to Canadian dollars and typically leave the funds in freedom dollars.

I have some plans to perhaps increase the contribution amounts to 10%, but we'll see. That might be too ambitious at the moment (kids are expensive after all).

Workplace Sunlife DCPP and RRSP

DCPP

So the way a defined contribution pension plan works is its an employer-matched workplace retirement savings account. In my case, if you redirect 6% of your pay, the employer will add on an additional 3%.

When you contribute to your workplace DCPP, you might pay less income tax since it's deducted at source. Just like an RRSP, your DCPP money also grows tax-free until you withdraw it. Contributions you make to a DCPP are deducted from the yearly RRSP contribution limits.

Also, note - if you get terminated and/or leave your employer, participation in the plan usually ends. You can decide to stay with Sunlife, and/or transfer to another financial institution (employer contributions are usually locked in till retirement though)

Invested in a low-cost US S&P 500 index fund.

RRSP

Just your typical RRSP account; I'm planning to start contributing 2% of each pay towards this (again the intent is to perhaps reduce taxes paid at source -- not sure it will work this way, but either way it'll all balance itself out at tax filing time)

Invested in a low -ost US S&P 500 index fund. The plan is to transfer out to Wealthsimple periodically once I reach a certain threshold.

Wealthsimple

RESP

The Registered Education Savings Plan (RESP) is a long-term savings plan to help people save for a child's education after high school, including trade schools, CEGEPs, colleges, universities, and apprenticeship programs.

Under the Canada Education Savings Grant (regardless of family income), the government matches 20% on the first $2,500 contributed annually to an RESP, to a maximum of $500 per beneficiary per year. The lifetime maximum per beneficiary is $7,200, up to age 18.

I have a joint account with my spouse - we currently only have one child, but we set up the account as a family RESP. Wealthsimple currently only offers a robo-advised managed account for RESPs; hopefully,at some point in the future,they will offer an RESP trade account. The account is following a Halal theme and is currently set up as a 90% equity portfolio.

If you have more than one child, a family plan may be the right option as the savings can be shared among all your children. In a family plan, all beneficiaries must be related, by blood or adoption, to the plan subscriber, such as grandchildren, great-grandchildren, brothers or sisters. Beneficiaries can also be added or changed over the RESP's lifetime. When allocating the money, each beneficiary must use a portion — although not necessarily equally. “This means that, if you have a child who will be going to medical school,” says Walker, “he or she will be able to utilize more of the savings than another child who does a college diploma in media studies.”

“Two fundamental questions are: who will go to school first and whose program will be more expensive?” says Walker. She advises parents to take a look at how far away school is, how much it will cost when the kids are ready to go, and who is likely to go to a post-secondary institution and who isn’t.

In both plans, the federal government will grant up to a maximum of $7,200 per beneficiary until they turn 18 years of age. In a family plan, grant money can be shared, but the lifetime maximum of $7,200 per beneficiary must be respected. Any portion of the grant not used by beneficiaries must be returned to the government upon closing the RESP. And in both cases, RESPs must be terminated after 35 years of existence.

We contribute the yearly amount to maximize the government grant amount; that being said, we are putting in a bit extra here and also saving elsewhere as well. My son's grandparents have been extra gracious - so most of their monetary gifts have been redirected to the RESP account as well.

RRSP

Weekly contributions going into XEQT, TEC, VFV

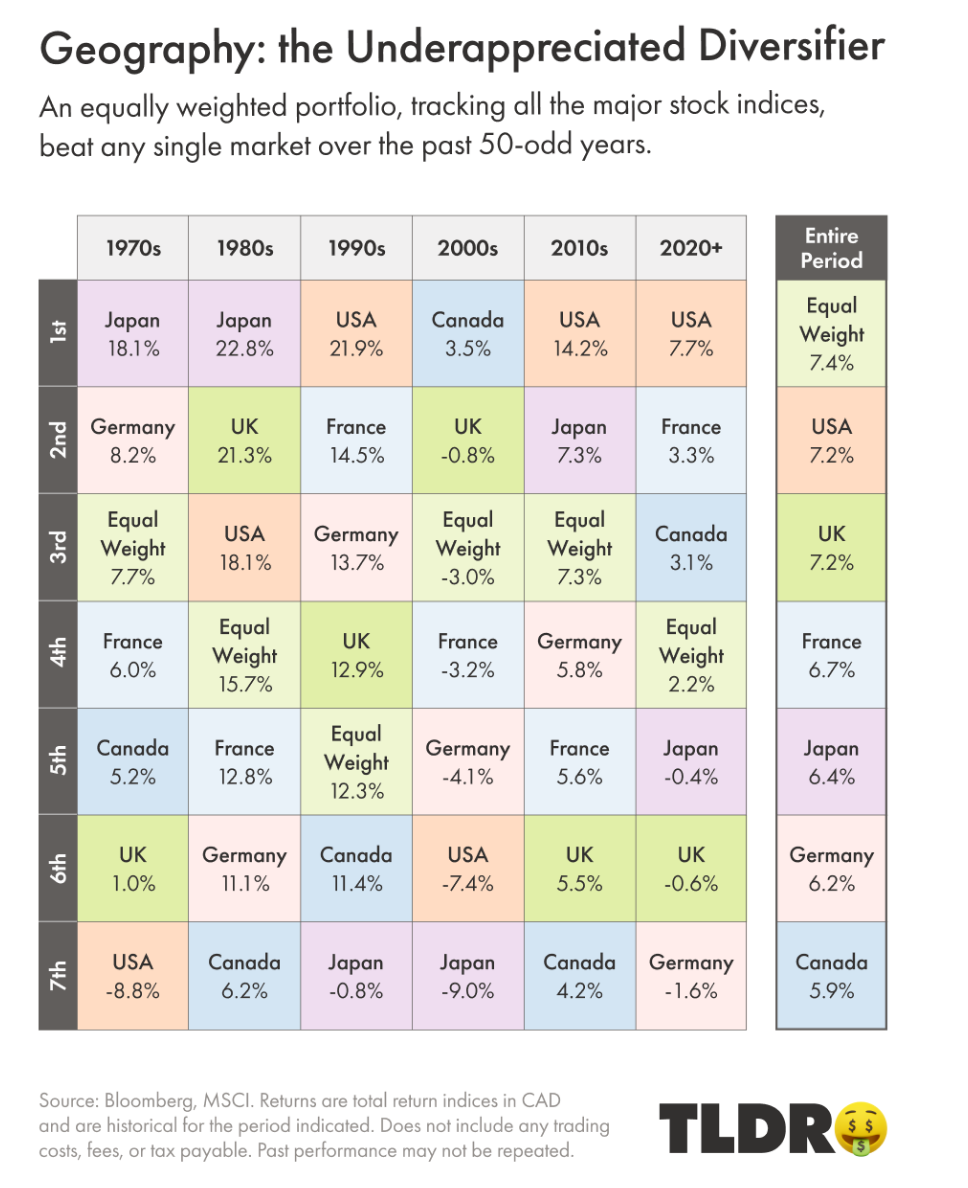

Why did I not just go all in XEQT? Well, I think having a 25% Canadian bias is too high; after all, Canada is only a tiny drop in the world economy bucket.

So I diluted it with some VFV which tracks the US S&P 500 index. Past performance is no indication of future results, but the US economy has been doing well lately so I'm willing to hedge my bets here a little. Also wanted to get in on some of the high-tech companies by grabbing TEC.

The bulk remains in XEQT, however.

TFSA

Weekly contributions going into XGRO (i.e. 80% equity)

Pardon the humble brag, but I've thankfully never really had to dip into my TFSA for funds. I treat it as a long-term savings vehicle, so I'm willing to take on more risk. But not XEQT levels of 100% risk!

Non-registered

This is just a sink for my extra savings; usually invest in high-interest savings ETFs like CASH.to and a few dividend ETFs. Nothing too risky since this includes my emergency fund and general savings.